ATLANTA — Enacted by the 117th Congress in 2022, the Inflation Reduction Act gave tax-exempt entities like local governments, schools, hospitals, public utilities, churches and community organizations an opportunity to receive Direct Pay tax credits when they build renewable energy projects like solar, wind or electric vehicle charging stations for the first time. The act had a 10-year term limit, set to expire in 2032.

Businesses and homeowners claim these credits on their tax returns once their projects are completed and meet the prescribed specifications. Direct Pay (also known as Elective Pay) created an opportunity for nonprofit entities to receive the value of certain clean energy tax credits as direct cash payments, offsetting about 30% of the cost of specific projects. This extended the opportunity for nonprofit organizations, including churches, to build sustainable energy infrastructure, contribute to cleaner air and water, and create green jobs.

On July 4, 2025, the 119th Congress signed into law the H.R. 1 reconciliation bill, known as the One Big Beautiful Bill (OBBB). H.R. 1 changed the term limit of Direct Pay, so it now expires at the end of 2027, and it adds new eligibility rules for projects constructed between now and then.

What churches need to know about Direct Pay

Although the federal Direct Pay program is ending sooner than expected, there is time before the program expires. However, new restrictions come into play for projects that start in 2026.

Global Ministries Environmental Sustainability Program director, the Rev. Jenny Phillips, says projects that have been completed or have “started construction” before Dec. 31, 2025, will be eligible to file under the pre-H.R. 1 rules. “Started construction” means at least 5% of the total, final project cost is paid and/or physical work has commenced.

Projects that start construction by Jan. 1, 2026, or later, will be subject to rules related to equipment content from “Prohibited Foreign Entities.” The rules about what this means should be released sometime in August 2025. In addition, projects must begin construction by July 4, 2026, or be placed in service before Dec. 31, 2027.

Credits for storage (batteries) will be available through December 2033, subject to the Prohibited Foreign Entities rules.

The Global Ministries Environmental Sustainability Program will continue to host its monthly Zoom meeting for United Methodists who are planning to file or are in the process of filing for Direct Pay. Most participants relate to their churches’ finance or trustee committees as volunteers or staff. The meeting’s primary agenda is for participants to discuss questions and share information with one another about Direct Pay rules and the filing process. To receive the Zoom meeting link, email environment@umcmission.org.

The Oct. 2-5 EarthKeepers training this year takes place in Washington state, and participants will have an opportunity to ride the ferry to Vashon Island to visit Vashon UMC and learn about its ministries. The deadline to apply for this EarthKeepers training is Aug. 21, 2025. See details here: https://umcmission.org/earthkeepers/.

Laity interviewed from three United Methodist churches that completed their solar projects all agreed that transitioning from fossil fuel usage to renewable energy is possible and even affordable if you know where to look for funding, even for small churches. Not one, however, said it was an easy journey, though well worth the time and effort.

Churches installed solar with help from Direct Pay

How did Vashon United Methodist Church on Vashon Island, Washington, achieve its dream of solar-powered independence? Church member Eric Walker noted: “It took the right season, the right conference, the right state, and in many ways, the right people to get this done.”

READ MORE ABOUT VASHON UMC

Walker is a retired CFO and Vice President of Operations for a large, international nonprofit, so he knew the ins and outs of grant applications and proposals. “I’m very familiar with chasing money,” he said. Even so, five years ago his congregation felt the hurdles were too great to make any big investment in conversion.

In Washington state, the Department of Commerce began multiple grant programs to aggressively pursue green energy tied to justice. The state then began funneling funding opportunities to communities that did not have access to green energy before. Vashon UMC applied for a grant that would cover both solar installation and battery storage, because the church also applied to be a resilience hub.

On an island that is only accessible by water or air, the need for a shelter that could function off the grid, when power goes down in an emergency, is vital. The small but mighty congregation of Vashon UMC designed its facility to meet that need.

With the state grant and Direct Pay, Vashon was able to recover the entire cost of its solar projects. Though Direct Pay takes a while to receive after the projects are completed, the church secured a loan from Faith Foundation West in the Pacific Northwest Conference to cover the gap.

Walker and Vashon worked very closely with Global Ministries Environmental Sustainability Program through its director, the Rev. Jenny Phillips. The Federal Government requires just the right forms filed the right way by people who know what they are doing. It also requires online filing with special tax form software.

Economic sense can power the leap to solar

On the U.S. East Coast, First United Methodist Church in Hendersonville, North Carolina, was laying out $75,000 annually to meet its energy bills, and those costs continue to rise. Bob Doughty, the church’s facilities manager, said they were dealing with a boiler system from the 1920s.

“Half of the church was steam, and the other half was water-baseboard, and with that comes lots of opportunities for leaks and downtime if the boiler goes out, which it did.”

READ MORE ABOUT FIRST UMC, HENDERSONVILLE, N.C.

It got so they had to run the air conditioning in the winter because the boiler had lost its ability to regulate the heat and ran at full blast.

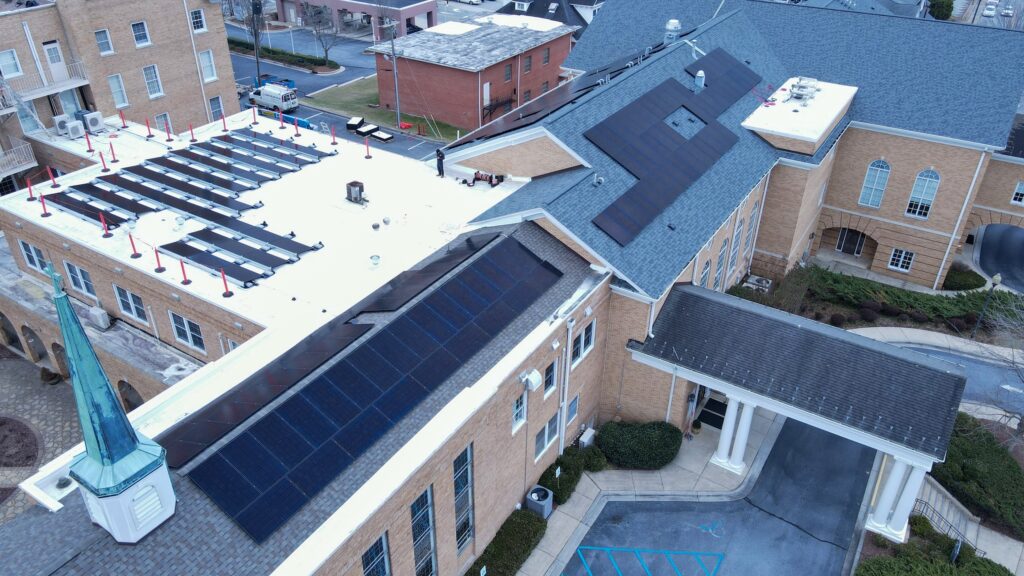

First UMC worked with a local solar company to install a huge solar panel array on several areas of the large church. Unlike Vashon UMC, the Hendersonville church chose net-metering over battery storage. Rather than storing the surplus energy produced by the solar panels for later use, net-metering sends the surplus to the electrical grid and the utility company pays for the surplus in the form of credits to their energy bill. Though energy costs continue to rise, they cut 50% of their energy costs that first year.

Like Vashon, First UMC is a major community hub. “Every day we have hundreds of people here,” noted Doughty, “going to the Council on Aging, AA meetings, Alzheimer’s meetings. Our whole mission is to provide services for our community, along with our teaching and religious worship. People come in for all kinds of services. We needed a facility that functions and saves money.”

Doughty and Joe Donoghue, an EarthKeeper and member of First UMC, also attended Global Ministries webinars with Rev. Phillips. With North Carolina’s green energy program and Direct Pay, their solar conversion was economically feasible.

We are environmentally focused

(Photo: Courtesy of Edmonds UMC)

Edmonds UMC, in Edmonds, Washington, on the shores of Puget Sound just below Seattle, had green energy on its “to-do” list for a long time. A dedicated group in the congregation wanted solar energy for environmental reasons, but it wasn’t economically feasible until they found local and federal funding programs.

READ MORE ON EDMONDS UMC

Stan Gent, prefers to think in broad strokes when it comes to how United Methodist churches can help to sustain environmental balance. He maintains that a United Methodist Church shouldn’t be in this process alone, and he leans on the Social Principles and the connectional tradition of Methodists. The Pacific Northwest Conference is engaging all its churches to reduce their carbon footprint.

“There has to be some bigger thinking. Is there a way to understand that part of our church ethos is to care for the land and the world itself? We are environmentally focused,” Gent noted. “That should be a big part of how we manage our investment assets as well. It’s just that we haven’t looked at the resources we have.”

Christie R. House is a consultant writer and editor with Global Ministries and UMCOR.